Import Procedures

Import

Import is explained as bringing products into own country from a

place outside the national border. It can be said that Import trade refers to the

purchase of goods from a foreign country. The procedure for import trade varies

from country to country depending upon the import policy, statutory

requirements, and customs policies of different countries. In almost all

countries of the world import trade is controlled by the government. The aims

of these controls are the appropriate use of foreign exchange restrictions, protection

of indigenous industries, etc. The imports of goods have to follow a procedure.

A manufacturer's import department often grows out of the

purchasing department, whose personnel have been assigned the responsibility of

procuring raw materials or components for the manufacturing process. For

importers or trading companies that deal in finished goods, the import

department may begin as a result of being appointed as the distributor for a

foreign manufacturer (Johnson, 2010).

In the Indian context, the import and export of goods is ruled by

the Foreign Trade (Development & Regulation) Act, 1992, and India’s Export-Import (EXIM) Policy. India’s Directorate General of Foreign Trade (DGFT) is

the major governing body and is responsible for all issues associated with EXIM

Policy. Importers are essential to register with the DGFT to obtain an Importer

Exporter Code Number (IEC) issued against their Permanent Account Number (PAN),

before engaging in EXIM activities. After an IEC has been obtained, the source

of items for import must be identified and declared. The Indian Trade

Classification – Harmonized System (ITC-HS) allows for the free import of most

goods without a special import license.

Basic Import Procedures

- Setting Market

Objectives:

- Setting market

objectives on pricing and terms

- Sourcing Products:

- Identifying

potential suppliers

- Sourcing channels

of distribution

- Trade Regulations:

- Import

regulations and requirements, and checking whether an import license is

required

- Patent, trademark, and copyright

- Making Contacts:

- Sending enquiries

to suitable suppliers

- Settling Quotation

and Terms:

- Analyzing the

supplier's quotation and offers

- Costs and terms

of sale

- Financing the

Purchase:

- Preparing for

working capital

- Types of bank

financing and applications, such as exporter credit or other bank

facilities

- Sales Contract:

- Confirming the

sales contract and terms of transaction such as payment terms.

- Preparing Payment

and Insurance:

- Preparing

payments and insurance specified in the sales contract (eg. when the payment term

is D/C, submit a D/C application to the issuing bank; when the trade term is

FOB, arrange a cover note with an insurance company).

- Preparing

insurance, and cover notes, when necessary

- Acquiring Goods:

- Receiving

shipping advice and arrival notice

- Receiving export

documents from the exporter

- Collecting goods

from the specified shipping company or forwarder

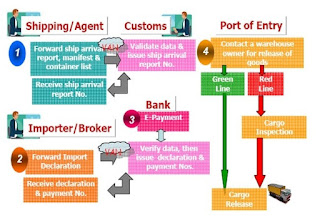

- Customs Clearance:

Arranging customs clearance and import declaration

Import Procedure

All importers must have to follow detailed customs clearance formalities

when importing goods into India. A complete overview of EXIM procedures can be

found on the Indian Directorate of General Valuation's website.

It is established in finance literature that smooth, efficient, and compliance-oriented exporting, and importing needs specialized knowledge of

personnel. In many companies, some or all functions of the export and import

department are combined in some way. In smaller companies, where the volume of

export and import does not justify more personnel one or two persons may have

responsibility for both export and import documentation and procedures. In

giant companies, these functions tend to be separated into the export department

and import department (Johnson, 2010).

It is beneficial for companies to have export and import manual

of procedures and documentation. These manuals serve as an effective tool for

smooth operations and as a training tool for new employees. Exporters and

importers must maintain records relating to their international trade

transactions. Many companies offer software programs for managing the export

process such as order taking, generating of export documentation compliance

with export control regulations, and calculation of transportation charges and

duties. On the import side, many companies offer supply chain management software.

No comments